Global Market Research 2020 – Top Findings

22nd April 2021

The Global Market Research 2020 report provided by ESOMAR illustrates the positive and negative changes that happened in the industry in 2019, just before the pandemic started. It is believed that the market research industry faces not only a new era of challenge but also considerable opportunity.

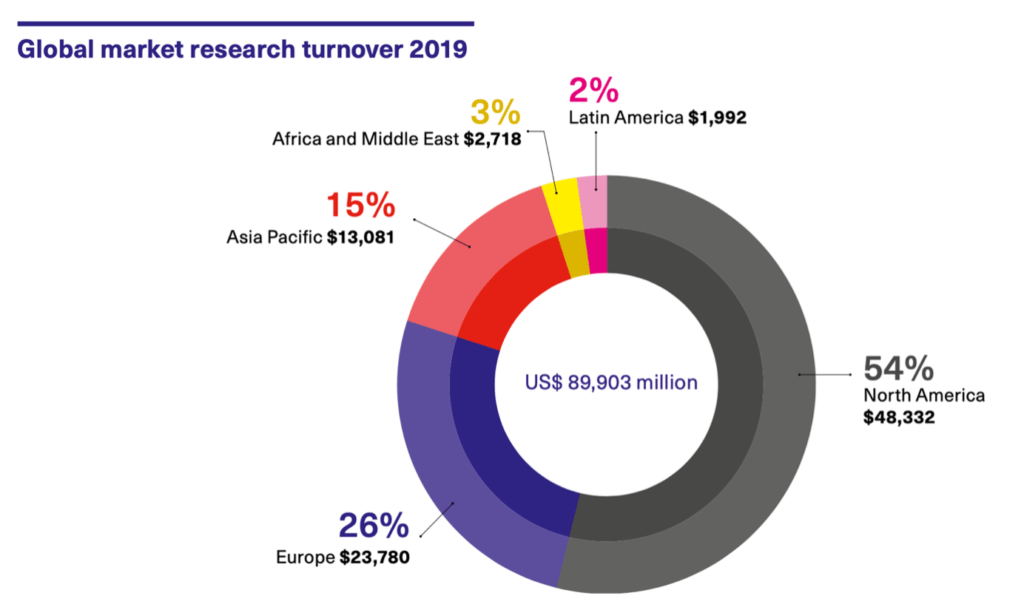

Global market research turnover grows by 42 million dollars

The report confirms that the global insights industry continued to grow by 5.9% in absolute terms. The turnover increased from $47,363 million in 2019 to 89,903 million in 2019, a growth of $42,450.

Thanks to the improvement in figures, it is now possible to estimate the global share of the world’s regions and the composition of their industry. The 6.1% increase in the share of North America to 54%, saw Europe shrinking to 26%. Asia Pacific maintained its 15% share within the world, the Middle East and Africa have a combined share of 3% and, finally, Latin America gathers the remaining 2% of the share.

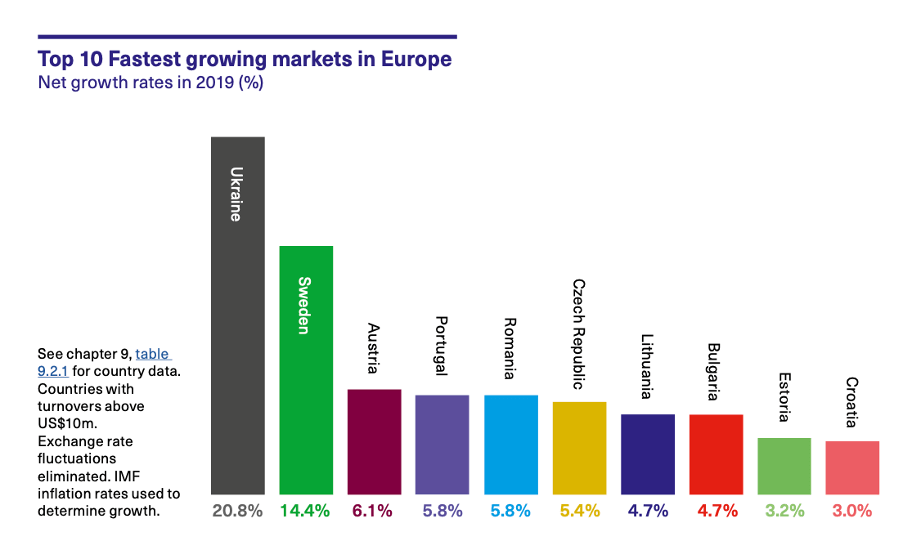

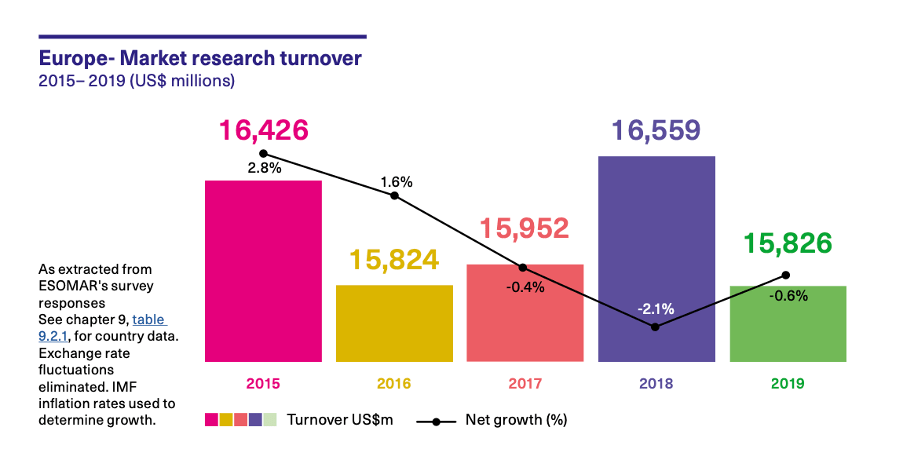

Europe shows a sluggish growth

The growth which initially appeared to be a positive growth rate of +1.1% in absolute terms turned into a negative -0.6 after factoring in inflation. The most prominent drops and increases were seen for the Netherlands, with a negative net growth of -10.7%, Sweden with an outstanding +14.4% growth rate, a 3.8% drop in real terms for Germany, an almost flat -0.6% in the UK and a positive +1.7 % in France.

The largest European market, the UK, preserves its global reputation of innovative research disciplines as well as being a central hub for global projects. However, it is predicated that the consequences of Brexit, in addition to complications posed by the pandemic, will have had a negative effect on UK growth in 2020.

The European market research turnover has seen fluctuations over time. In 2015 it was reported at $16,246 million, with the highest figure started in 2018 at $16,559 million (mainly due to the tech-enabled sector growing at a rate of +10.1%).

2019 has shown the second lowest turnover of 15,826$ million.

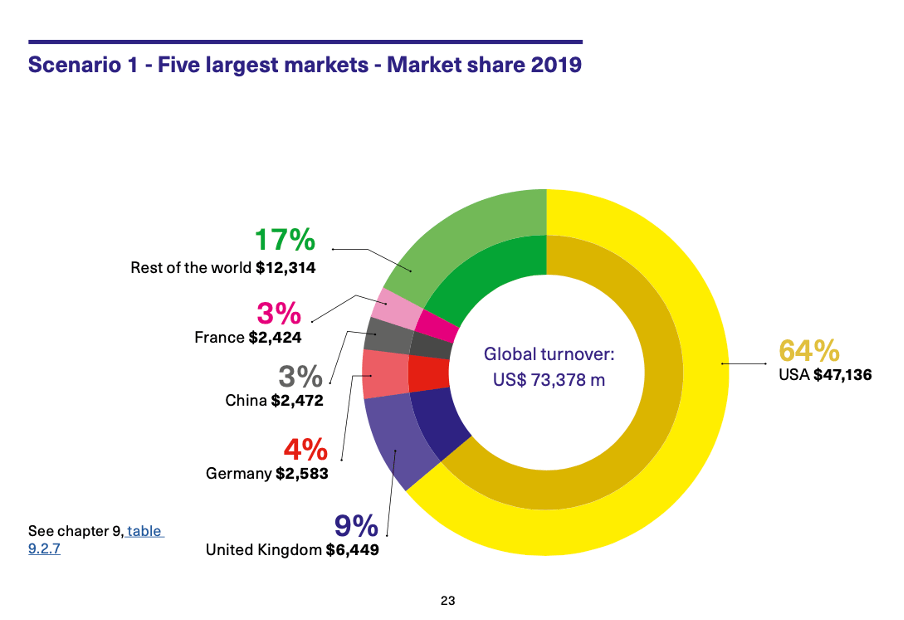

Five larger markets in 2019

2019 was a year of the US. This report shows a substantial expansion in the relative share of the US. Consequently, when considering the total value of the US insights industry against that of the countries of the world, its global share has soared from 44%, as was reported in the 2019 Global Market Research report, to 64% in the 2020 report. As a result, the shares of the rest of countries have shrunk:

- UK’s global turnover went down from 14% in 2018 to 9% in 2019

- Germany – from 6% to 4%

- China and France- from 5% to 3%

Multi-country projects and their destination

For the first time, ESOMAR included a question in its yearly survey to associate countries on the size and destination of research projects. Although the full picture is still somewhat incomplete, it is estimated that around 29% of all research is carried out in the shape of multi-country studies.

Spend by research method

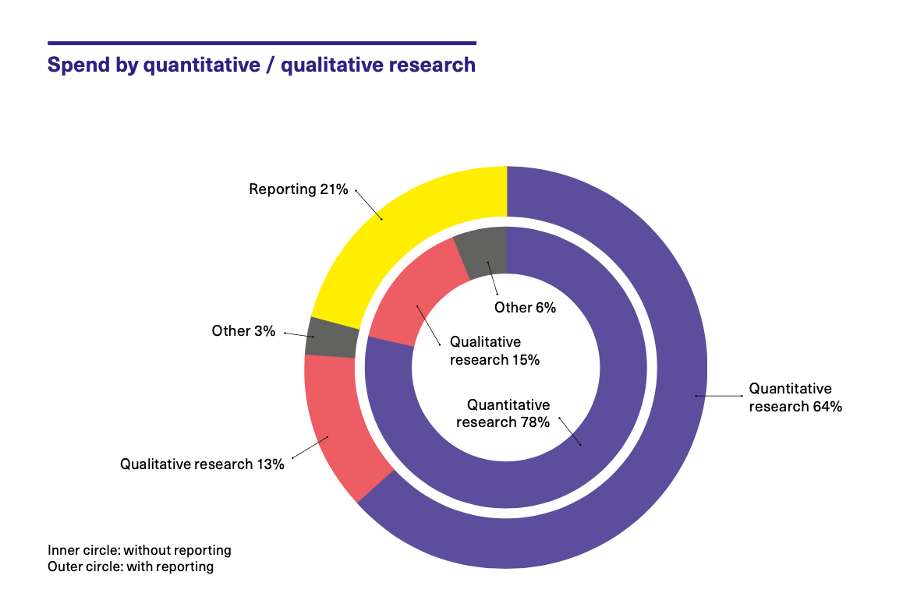

The estimated global share of reporting activities is estimated at around 21%. The remaining 79% is then divided between 64% quantitative research, 12% qualitative research and 3% for other uncategorised methods.

It is worth to point out that the estimation of the reporting activity, which had remained rather unobserved until now (last year only secondary research was estimated), shrinks the relative weight of both quantitative and qualitative research. If reporting activity was excluded from the picture, we would obtain a much closer comparison to previous years of 78% quantitative, 15% qualitative and 6% other.

Will the crisis unfolded by the Covid-19 pandemic lead to decreased growth levels and turnovers?

It is predicted that the global insights industry may be heading for a very substantial shock; a one-year decline of up to -25.3%, shedding in the process almost US$ 20 billion in turnover.

If it wasn’t for the pandemic, we could have seen a positive growth and an increase up to +3.9%, translated into a gain in turnover of almost US$ 3 billion.

Foreign Tongues are the market research translation agency. We have provided translation and interpreting services to the market research industry for more than a quarter of a century. We provide the Quote, with detailed cost breakdown, within 20 Minutes of receiving Client brief. Submit your, free, no obligation Quote request here.