Global Market Research Report 2018 – Top findings

25th April 2019

As the research industry continues to grow we have looked at the details provided by The Global Mark Research 2018 report. This article outlines the main findings and challenges faced by the market research industry.

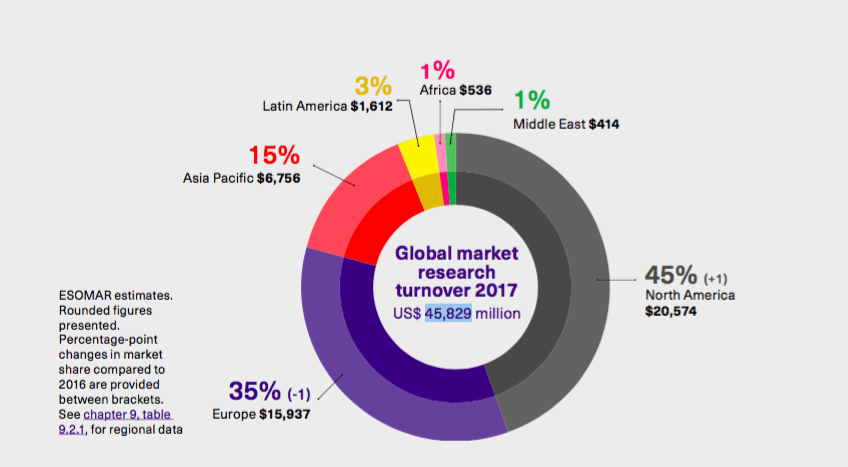

1. Global turnover grows by 1%

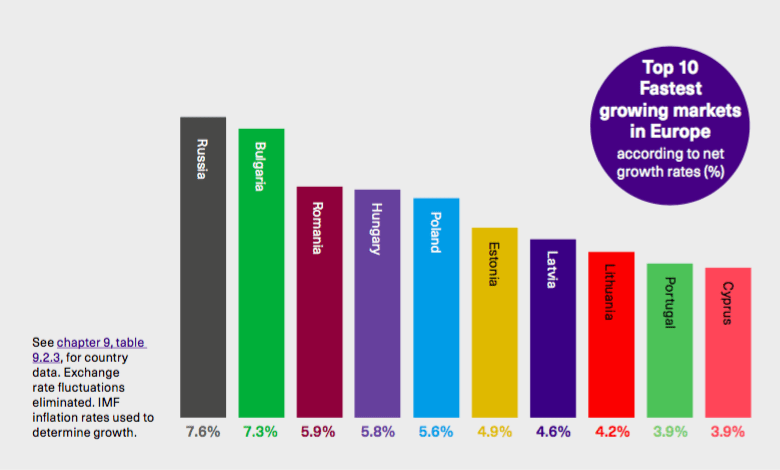

2017 saw the shrinkage of Europe’s share in the world landscape by 1 percentage point, down to 35% with the United Kingdom showing the only positive growth rate. Germany and France saw declines in national turnover. Russia, Bulgaria and Romania were showing the fastest growth rate in 2017.

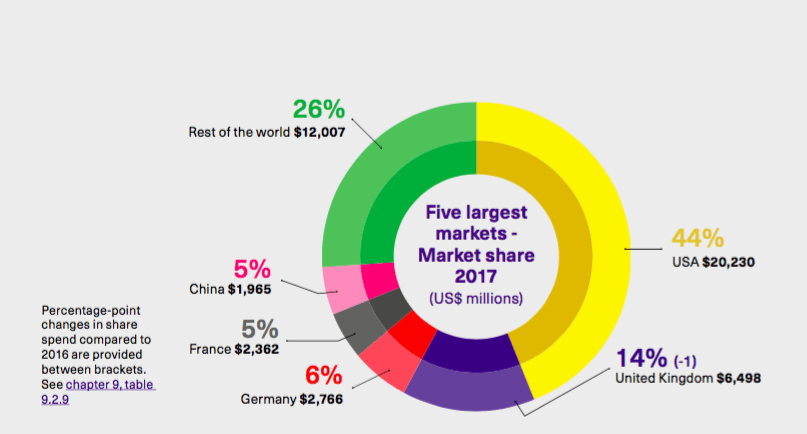

2. The largest markets

The industry has witnessed the exchange of positions in the ranking, as the 5th and 6th largest world markets with China taking the 5th position and Japan dropping to position 6. The United States was the largest market with 44% of total turnover.

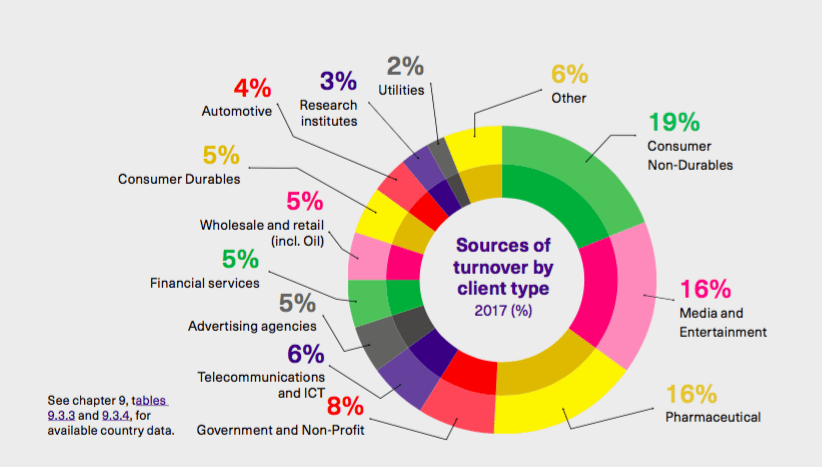

3. Consumer Non-Durables top spending segment

More than half of all research conducted in the world falls under just 3 segments: Consumer Non-Durables (CND), Media and Entertainment and Pharmaceutical, with a combined 51% of total share since 2015. CND has been declining for the last 3 years, from 23% in 2015 to 19% in 2017.

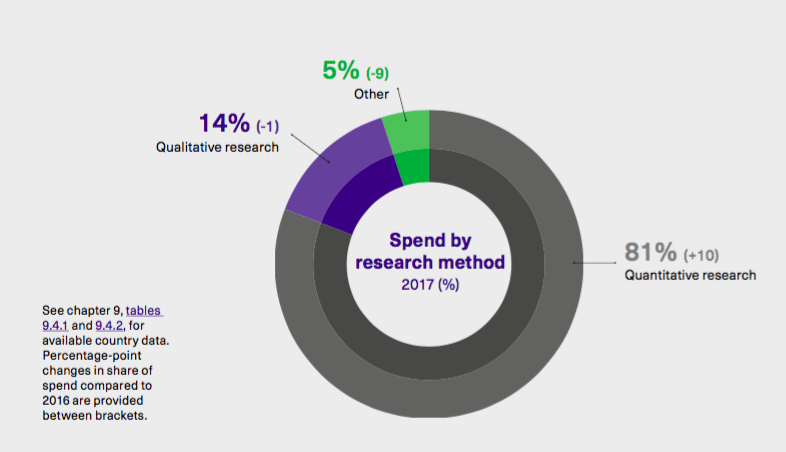

4. Change to the spend

The marked increase reported in the amount of research spend dedicated to quantitative methods (from 71% in 2016 to 81% in 2017) is mainly a result of a change in how the United Kingdom reports on these segments – what was previously reported as a generic “other” has now been allocated into “Quantitative”.

The methods of quantitative research included online quantitative research (25%), telephone (14%), other quantitative (10%), face to face (9%), automated digital (8%), mobile/smartphone online quantitative research (8%), online traffic/audience management (6%) and mail (1%). The total share of these online methods adds up to 42%, down from 44% for 2016. Japan had the highest share of research conducted online followed by Iraq, New Zealand, Australia and Singapore. Face-to-face methods were most popular in Pakistan, Kenya, Bolivia, Turkey and Vietnam.

Qualitative research claimed 14% of market share in 2018, with Focus groups taking the highest, 5% share. Other methods included online research communities (3%), in-depth face-to-face interviews (2%), online groups, discussions and bulletin boards (2%), mobile ethno, mobile diaries, photo boards (1%) and traditional ethnography (1%).

2018 has seen several changes in the Market Research Industry. The countries remain positive, with 58% of all countries expecting the sector to continue expanding next year, and a further 27% not expecting any change.

The report uncovered new approaches to market research. New technologies enforce changes to our lifestyle. We communicate and interact in different ways than we used to and businesses have a new array of methods to reach their customers; methods which open the possibility of new types of research and less intrusive means for generating insights. Artificial intelligence and automation are changing the way insights are collected, analysed and activated and open tremendous opportunities for businesses to harness billions of data points. However, every change comes with new challenges. “Digitalisation, pressure on research budgets, a demand for insights functions to become more predictive and forward-looking, and the desire to see insights activated more; all these contribute to the change that is currently happening.”

As Stephen Gans said that:

“Market forces dictate that the insights industry needs to get better, faster and cheaper. Clients demand it and the technology is here to enable it. As a result the sector is currently in a state of flux that will see it transformed radically.”